847.949.8373 Illinois262.375.2440 Wisconsin

Illinois - 847.949.8373

Wisconsin -262.375.2440

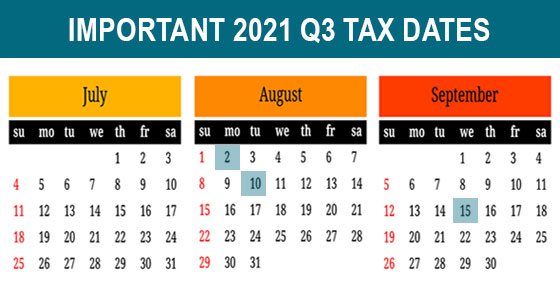

2021 Q3 Tax Calendar: Key Deadlines for Businesses & Other Employers

Here are some key tax-related deadlines for businesses and other employers during the third quarter of 2021.

Here are some key tax-related deadlines for businesses and other employers during the third quarter of 2021.

AUGUST 2

Employers report income tax withholding and FICA taxes for second quarter 2021 (Form 941) and pay any tax due.

File a 2020 calendar-year retirement plan report (Form 5500 or Form 5500-EZ) or request an extension.

SEPTEMBER 15

If a calendar-year S corporation or partnership that filed an automatic extension, file a 2020 income tax return.

If a calendar-year C corp., pay the third installment of 2021 estimated income taxes.

Accounting Freedom: Small Business Accounting Company

Contact us for more about the filing requirements and to ensure you meet all applicable deadlines.