Blog

Are you a tax-favored real estate professional?

For federal income tax purposes, the general rule is that rental real estate losses are passive activity losses (PALs). An individual taxpayer can generally deduct PALs only to the extent of passive income from other sources, if any. For example,...

Read more

Business owners should get comfortable with their financial statements

Financial statements can fascinate accountants, investors and lenders. However, for business owners, they may not be real page-turners. The truth is each of the three parts of your financial statements is a valuable tool that can guide you toward reasonable,...

Read more

6 essential tips for small business payroll tax compliance

Staying compliant with payroll tax laws is crucial for small businesses. Mistakes can lead to fines, strained employee relationships and even legal consequences. Below are six quick tips to help you stay on track. 1. Maintain organized records Accurate recordkeeping...

Read more

Weighing the pluses and minuses of HDHPs + HSAs for businesses

Will your company be ready to add a health insurance plan for next year, or change its current one? If so, now might be a good time to consider your options. These things take time. A popular benefits model for many...

Read more

Planning for the future: 5 business succession options and their tax implications

When it’s time to consider your business’s future, succession planning can protect your legacy and successfully set up the next generation of leaders or owners. Whether you’re ready to retire, you wish to step back your involvement or you want...

Read more

How to evaluate and undertake a business transformation

Many industries have undergone monumental changes over the last decade or so. Broadly, there are two ways to adapt to the associated challenges: slowly or quickly. Although there’s much to be said about small, measured responses to economic change, some...

Read more

Exploring business entities: Is an S corporation the right choice?

Are you starting a business with partners and deciding on the right entity? An S corporation might be the best choice for your new venture. One benefit of an S corporation One major advantage of an S corporation over a partnership is that...

Read more

2025 – 03/10 – Exploring business entities: Is an S corporation the right choice?

When starting a new business, you have several entity options to consider. One option is an S corporation. Here are some of its advantages. https://bit.ly/3D2eBFa

Read more

Choosing the right sales compensation model for your business

A strong sales team is the driving force of most small to midsize businesses. Strong revenue streams are hard to come by without skilled and engaged salespeople. But what motivates these valued employees? First and foremost, equitable and enticing compensation....

Read more

Maximize Your Business Tax Deductions

You don't want to wait until tax season is in full swing to plan ahead and take advantage of key business tax deductions. If you freelance or have your own business, there are so many valuable tax deductions that you...

Read more

How a business owner’s home office can result in tax deductions

As a business owner, you may be eligible to claim home office tax deductions that will reduce your taxable income. However, it’s crucial to understand the IRS rules to ensure compliance and avoid potential IRS audit risks. There are two...

Read more

5 steps to creating a pay transparency strategy

Today’s job seekers and employees have grown accustomed to having an incredible amount of information at their fingertips. As a result, many businesses find that failing to adequately disclose certain things negatively impacts their relationships with these parties. Take pay...

Read more

Questions about taxes and tips? Here are some answers for employers

Businesses in certain industries employ service workers who receive tips as a large part of their compensation. These businesses include restaurants, hotels and salons. Compliance with federal and state tax regulations is vital if your business has employees who receive...

Read more

On developing an effective IT modernization strategy

Information technology (IT) is constantly evolving. As the owner of a small to midsize business, you’ve probably been told this so often that you’re tired of hearing it. Yet technology’s ceaseless march into the future continues and, apparently, many companies...

Read more

Questions about taxes and tips? Here are some answers for employers

Businesses in certain industries employ service workers who receive tips as a large part of their compensation. These businesses include restaurants, hotels and salons. Compliance with federal and state tax regulations is vital if your business has employees who receive...

Read more

D&O insurance may be worth considering for some companies

Strong leadership is essential to running a successful business. However, as perhaps you’ve experienced, playing the role of a strong leader can force you to make tough decisions that expose you to legal claims. Business owners who are particularly worried about...

Read more

Essential QuickBooks Tips Every Small Business Owner Should Know

QuickBooks is one of the most widely used accounting solutions in the world. With desktop, mobile, and online versions geared towards small and medium-sized businesses, over 82,000 companies use QuickBooks. It is the most "universal" accounting software in the small...

Read more

Businesses: The Form W-2 and 1099-NEC deadline is coming up fast

With the 2025 tax filing season underway, be aware that the deadline is coming up fast for businesses to submit certain information returns to the federal government and furnish them to workers. By January 31, 2025, employers must file these forms...

Read more

So many KPIs, so much time: An overview for businesses

From the moment they launch their companies, business owners are urged to use key performance indicators (KPIs) to monitor performance. And for good reason: When you drive a car, you’ve got to keep an eye on the gauges to keep...

Read more

The standard business mileage rate increased in 2025

The nationwide price of gas is slightly higher than it was a year ago and the 2025 optional standard mileage rate used to calculate the deductible cost of operating an automobile for business has also gone up. The IRS recently...

Read more

3 ways businesses can get more bang for their marketing bucks

Most small to midsize businesses today operate in tough, competitive environments. That means it’s imperative to identify and reach the right customers and prospects. However, unlike large companies, your business probably doesn’t have a massive marketing department with seemingly limitless...

Read more

Small business strategy: A heavy vehicle plus a home office equals tax savings

New and used “heavy” SUVs, pickups and vans placed in service in 2025 are potentially eligible for big first-year depreciation write-offs. One requirement is you must use the vehicle more than 50% for business. If your business usage is between...

Read more

How companies can better control IT costs

Most small to midsize businesses today are constantly under pressure to upgrade their information technology (IT). Whether it’s new software, a better way to use the cloud or a means to strengthen cybersecurity, there’s always something to spend more money on....

Read more

Making the Switch: How to Transition Accounting Firms Seamlessly After Bench’s Closure

During the usually jubilant week between Christmas and New Year's, Bench, a Canada-based accounting startup, shut down abruptly, giving no prior notice to its employees or more than 12,000 clients (down from a purported 35,000 at its peak). Reasons cited...

Read more

Growing the business means supporting your managers

Many different shortcomings can hold back the growth of a company. Some are obvious, such as poor cash flow management or flawed strategic plans. Others aren’t so easy to see. Take, for example, disjointed or under-supported managers. If you don’t dedicate...

Read more

How Section 1231 gains and losses affect business asset sales

When selling business assets, understanding the tax implications is crucial. One area to focus on is Section 1231 of the Internal Revenue Code, which governs the treatment of gains and losses from the sale or exchange of certain business property....

Read more

Bench Closing: How Switching Accounting Firms Can Boost Your Business

Recently, the accounting startup Bench was acquired by Employer.com immediately after the company suddenly and unexpectedly shut down. While Employer.com will dedicate resources to reviving Bench's infrastructure and assist customers with logging back and accessing their data, this came as...

Read more

Understanding the Work Opportunity Tax Credit

According to the U.S. Bureau of Labor Statistics, the unemployment rate continues to be historically low, ranging from 4.0% to 4.3% from May to November of 2024. With today’s hiring challenges, business owners should be aware that the Work...

Read more

Companies can shine a light on financial uncertainty with flash reports

Managing the financial performance of your business may sometimes seem like steering a ship through treacherous waters. Perhaps your voyage goes smoothly for a while until, quite suddenly, you hit a concerning dip or abrupt swell — either of which...

Read more

Operating as a C corporation: Weigh the benefits and drawbacks

When deciding on the best structure for your business, one option to consider is a C corporation. This entity offers several advantages and disadvantages that may significantly affect your business operations and financial health. Here’s a detailed look at the pros...

Read more

Companies can shine a light on financial uncertainty with flash reports

Managing the financial performance of your business may sometimes seem like steering a ship through treacherous waters. Perhaps your voyage goes smoothly for a while until, quite suddenly, you hit a concerning dip or abrupt swell — either of which...

Read more

The tax treatment of intangible assets

Intangible assets, such as patents, trademarks, copyrights and goodwill, play a crucial role in today’s businesses. The tax treatment of these assets can be complex, but businesses need to understand the issues involved. Here are some answers to frequently asked...

Read more

Businesses need to stay on top of their BYOD policies

In one way or another, most small to midsize businesses have addressed employees using personal devices for work. In 2022, online career platform Zippia reported that 83% of companies surveyed had a bring your own device (BYOD) policy “of some...

Read more

Drive down your business taxes with local transportation cost deductions

Understanding how to deduct transportation costs could significantly reduce the tax burden on your small business. You and your employees likely incur various local transportation expenses each year, and they have tax implications. Let’s start by defining “local transportation.” It...

Read more

Tax-Saving Moves to Make Before the Year Ends

Now that the holiday season is here, it's important to get year-end tax planning out of the way before relaxing with your loved ones. Tax policies change every year, and your income may look very different next year. It’s crucial...

Read more

ESOPs can help business owners with succession planning

Devising and executing the right succession plan is challenging for most business owners. In worst-case scenarios, succession planning is left to chance until the last minute. Chaos, or at least much confusion and uncertainty, often follows. The most foolproof way...

Read more

Beneficial Ownership Information Reporting: Key Requirements and Deadlines

The Corporate Transparency (CTA) was a landmark piece of legislation to lessen the presence of "dark money" in our daily lives, as many organizations frequently hide their true ownership and intents behind shell companies. Unlike publicly-traded companies that are required...

Read more

Self-employment tax: A refresher on how it works

If you own a growing, unincorporated small business, you may be concerned about high self-employment (SE) tax bills. The SE tax is how Social Security and Medicare taxes are collected from self-employed individuals like you. SE tax basics The maximum...

Read more

3 types of retirement plans for growing businesses

When start-ups launch, their focus is often on tightly controlling expenses. Most need to establish a brand and some semblance of stability before funding anything other than essential operating activities. For companies that make it past that tenuous initial stage,...

Read more

The amount you and your employees can save for retirement is going up slightly in 2025

How much can you and your employees contribute to your 401(k)s or other retirement plans next year? In Notice 2024-80, the IRS recently announced cost-of-living adjustments that apply to the dollar limitations for retirement plans, as well as other qualified...

Read more

Marketing your B2B company via the right channels

For business-to-business (B2B) companies, effective marketing begins with credible and attention-grabbing messaging. But you’ve also got to choose the right channels. Believe it or not, some “old school” approaches remain viable. And of course, your B2B digital marketing game must...

Read more

The Importance of Accurate Record-Keeping for Tax Preparation

Accurate record-keeping plays a critical role in small business tax planning and preparation. Inaccurate records can lead to missed deductions, inaccurate tax return filings, missed deadlines, IRS penalties, and unnecessary stress during tax time. Additionally, the results of poor record-keeping...

Read more

Small Business Year-End Accounting Checklist: Be Ready for 2025

Year-end financial preparation is essential to wrapping up your bookkeeping and accounting tasks before the end of the calendar year and the close of the fiscal year. Step 1: Reconcile Your Accounts Sound small business accounting requires the routine reconciliation...

Read more

2024 Tax Season Prep: A Small Business Survival Guide

When small business owners are busy overseeing day-to-day operations and focusing on the core functions of their businesses, they have little time left to think about taxes. Unfortunately, fiscal years tend to fly by when you're having fun (running a...

Read more

Advantages of keeping your business separate from its real estate

Does your business require real estate for its operations? Or do you hold property titled under your business’s name? It might be worth reconsidering this strategy. With long-term tax, liability and estate planning advantages, separating real estate ownership from the...

Read more

Working capital management is critical to business success

Success in business is often measured in profitability — and that’s hard to argue with. However, liquidity is critical to reaching the point where a company can consistently turn a profit. Even if you pile up sales to the sky, your...

Read more

Illinois Bookkeeping Checklist: Stay Tax Compliant

Illinois, the fifth-largest economy in the U.S., offers a strategic location for entering the Midwest market. However, to succeed, businesses must follow a comprehensive Illinois bookkeeping checklist to navigate the state's complex tax regulations and stay compliant. This guide provides...

Read more

Help ensure your partnership or LLC complies with tax law

When drafting partnership and LLC operating agreements, various tax issues must be addressed. This is also true of multi-member LLCs that are treated as partnerships for tax purposes. Here are some critical issues to include in your agreement so your...

Read more

Which leadership skills are essential to strategic planning?

To help ensure continued stability and profitability, businesses need to engage in some form of strategic planning. A recent survey by insurance giant Travelers drives home this point. In its 2024 CFO Study: A Travelers Special Report, the insurer surveyed 610...

Read more

The Benefits of Professional QuickBooks Support for Small Businesses

QuickBooks is one of the digital building blocks for small businesses across America. With millions of users, ranging from solopreneurs to enterprises with hundreds of locations, QuickBooks for small businesses is one of the most popular financial programs of all...

Read more

How to Improve Cash Flow Management with Effective Bookkeeping

Running a business comes with many challenges. Increasing revenue or finding ways to cut costs are important goals in a successful small business, but cash flow management is an aspect that can get overlooked. If the timing of your cash...

Read more

Understanding Wisconsin’s Tax Regulations: A Guide for Small Businesses

Thinking about starting a new business in Wisconsin, or expanding your operations to the Badger State? Wisconsin's unique geographic location offers prime opportunities for new customers throughout the Midwest, with proximity to Canada and major metros like Chicago and Minneapolis....

Read more

Top Accounting Tips for Illinois’ Construction Industry

All businesses require accounting systems tailored to their industries and other attributes, and the construction industry is no exception. Financial management for construction companies requires extra steps in compliance, accounting standards, tax laws, and more. Here are our expert accounting...

Read more

Closing a business involves a number of tax responsibilities

While many facets of the economy have improved this year, the rising cost of living and other economic factors have caused many businesses to close their doors. If this is your situation, we can help you, including taking care of...

Read more

Strategic planning for businesses needs to include innovation

When the leadership teams of many companies engage in strategic planning, they may be inclined to play it safe. And that’s understandable; sticking to strengths and slow, measured growth are often safe pathways to success. But substantial growth — and,...

Read more

If your business has co-owners, you probably need a buy-sell agreement

Are you buying a business that will have one or more co-owners? Or do you already own one fitting that description? If so, consider installing a buy-sell agreement. A well-drafted agreement can do these valuable things: Transform your business ownership...

Read more

How to Prepare for a Business Audit: Accounting Best Practices

The term "tax audit" usually refers to a government examination of specific items, divisions, or years when errors or fraud are suspected. On the other hand, a business audit involves an unbiased assessment by a third-party auditor of an organization's...

Read more

Vroom vroom: What businesses should know about sales velocity

Owning and running a company tends to test one’s patience. You wait for strategies to play out. You wait for materials, supplies or equipment to arrive. You wait for key positions to be filled. But, when it comes to sales,...

Read more

Be aware of the tax consequences of selling business property

If you’re selling property used in your trade or business, you should understand the tax implications. There are many complex rules that can potentially apply. To simplify this discussion, let’s assume that the property you want to sell is land...

Read more

The Top Bookkeeping and Accounting Trends for 2024

Business leaders and accounting professionals have found themselves in a completely new world as the future of accounting technology dawns over the past few years. Innovative technologies such as artificial intelligence (AI), machine learning, and blockchain are being widely adopted...

Read more

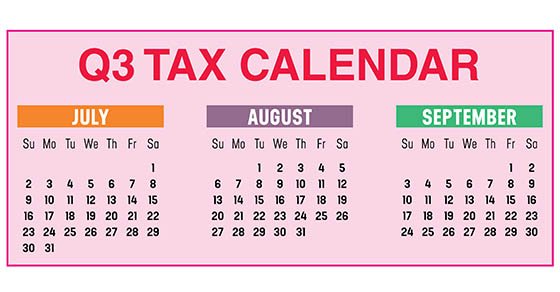

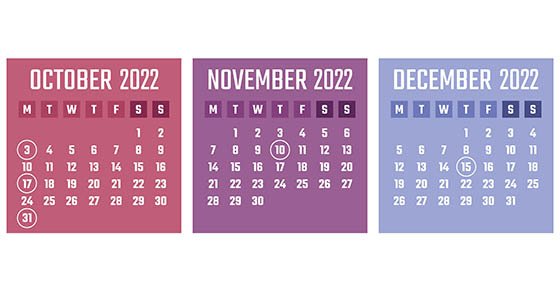

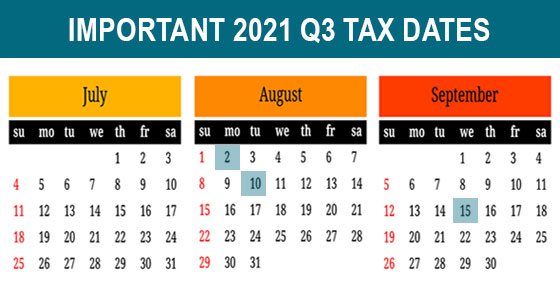

2024 Q3 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to...

Read more

Businesses have options for technology leadership positions

To say that technology continues to affect how businesses operate and interact with customers and prospects would be an understatement. According to the Business Software Market Size report issued by market researchers Mordor Intelligence, the global market size for commercial...

Read more

Hiring your child to work at your business this summer

With school out, you might be hiring your child to work at your company. In addition to giving your son or daughter some business knowledge, you and your child could reap some tax advantages. Benefits for your child There are...

Read more

How family businesses can solve the compensation puzzle

Every type of company needs to devise a philosophy, strategy and various policies regarding compensation. Family businesses, however, face additional challenges — largely because they employ both family and nonfamily staff. If your company is family-owned, you’ve probably encountered some puzzling...

Read more

Figuring corporate estimated tax

The next quarterly estimated tax payment deadline is June 17 for individuals and businesses, so it’s a good time to review the rules for computing corporate federal estimated payments. You want your business to pay the minimum amount of estimated tax...

Read more

4 ways businesses can better control cash flow

From the minute they open their doors, business owners are urged to keep a close eye on cash flow. And for good reason — even companies with booming sales can get into serious trouble if they lack the liquidity to...

Read more

Inflation enhances the 2025 amounts for Health Savings Accounts

The IRS recently released guidance providing the 2025 inflation-adjusted amounts for Health Savings Accounts (HSAs). These amounts are adjusted each year, based on inflation, and the adjustments are announced earlier in the year than other inflation-adjusted amounts, which allows employers...

Read more

Why businesses may want to integrate ESG into strategic planning

When business owners and their leadership teams meet to discuss strategic planning, the primary question on the table is usually something along the lines of, “How can we safely grow our company to reach the next level of success?” That’s certainly...

Read more

Could conversational marketing speak to your business?

Businesses have long been advised to engage in active dialogues with their customers and prospects. The problem was, historically, these interactions tended to take a long time. Maybe you sent out a customer survey and waited weeks or months to...

Read more

The tax advantages of including debt in a C corporation capital structure

Let’s say you plan to use a C corporation to operate a newly acquired business or you have an existing C corporation that needs more capital. You should know that the federal tax code treats corporate debt more favorably than corporate equity....

Read more

Businesses must face the reality of cyberattacks and continue fighting back

With each passing year, as networked technology becomes more and more integral to how companies do business, a simple yet grim reality comes further into focus: The cyberattacks will continue. In fact, many experts are now urging business owners and...

Read more

Growing Your Business with a New Partner: Here Are Some Tax Considerations

There are several financial and legal implications when adding a new partner to a partnership. Here’s an example to illustrate: You and your partners are planning to admit a new partner. The new business partner will acquire a one-third interest...

Read more

8 Key Features of a Customer Dispute Resolution Process for Businesses

No matter how carefully and congenially you run your business, customer disputes will likely happen from time to time. Some of the complaints may be people looking to negotiate a discount, “game the system” or even outright defraud you. But others...

Read more

When Businesses May Want To Take A Contrary Approach with Income and Deductions

Businesses usually want to delay taxable income into future years and accelerate deductions into the current year. But when is it wise to do the opposite? And why would you want to? One reason might be tax law changes that...

Read more

Health Care Self-Insurance and Stop-Loss Coverage: What Business Owners Need To Know

For businesses, cost-effective employer provided health benefits is an ongoing battle. In the broadest sense, you have two options: fully insured or self-funded. A fully insured plan is simply one you buy from an insurer. Doing so limits your financial...

Read more

Scrupulous Records & Legitimate Business Expenses Are The Key To Less Painful IRS Audits

If you operate a business, or you’re starting a new one, you know records of income and expenses need to be kept. Specifically, you should carefully record tax deductible expenses to claim all the deductions to which you’re entitled. And...

Read more

A General Look At Generative AI For Businesses

If you follow the news, you’ve probably heard a lot about artificial intelligence (AI) and how it’s slowly and steadily expanding into various aspects of our lives. One widely cited example is ChatGPT, an AI “chatbot” that can engage in...

Read more

3 Common Forms of Insurance Fraud (and How Businesses Can Fight Back)

Businesses of all shapes and sizes are well-advised to buy various forms of insurance to manage operational risks. But insurance itself is far from risk-free. You might overpay for a policy that you don’t really need. Or you could invest...

Read more

Update on IRS Efforts to Combat Questionable Employee Retention Tax Credit Claims

The Employee Retention Tax Credit (ERTC) was introduced back when COVID-19 temporarily closed many businesses. The credit provided cash that helped enable struggling businesses to retain employees. Even though the ERTC expired for most employers at the end of the...

Read more

Seeing The Big Picture With An Enterprise Risk Management Program

There’s no way around it — owning and operating a business comes with risk. On the one hand, operating under excessive levels of risk will likely impair the value of a business, consume much of its working capital and could...

Read more

Tax-Favored Qualified Small Business Corporation Status Could Help You Thrive

Operating your small business as a Qualified Small Business Corporation (QSBC) could be a tax-wise idea. Tax-Free Treatment for Eligible Stock Gains QSBCs are the same as garden-variety C corporations for tax and legal purposes — except QSBC shareholders are...

Read more

Account-Based Marketing Can Help Companies Rejoice In ROI

When it comes to marketing, business owners and their leadership teams often assume that they should “cast a wide net.” But should you? If your company is looking to drive business-to-business (B2B) sales, a generalized approach to marketing could leave...

Read more

The Standard Business Mileage Rate Will Be Going Up Slightly in 2024

The optional standard business mileage rate for 2024 will be going up by 1.5 cents per mile. This deduction is used to calculate the cost of operating an automobile for business. The IRS recently announced that the cents-per-mile rate for...

Read more

Reinvigorating Your Company’s Sales Efforts Heading Into The New Year

Business owners, the year is just about over. You and your leadership team presumably have a pretty good idea of where you want your company to go in 2024. The question is: Can you get there? When it comes to...

Read more

Giving Gifts & Throwing Parties Can Help Show Gratitude and Provide Tax Breaks

The holiday season is here. During this festive season, your business may want to show its gratitude to employees and customers by giving them gifts or hosting holiday parties. It’s a good time to review the tax rules associated with...

Read more

How Businesses Can Get Better At Data Capture

It would be hard to argue against the notion that almost every kind of business today is data-driven. Without the information you need to run your company — be it financial metrics, marketing demographics or productivity measures — you’d probably...

Read more

A Company Car Is A Valuable Perk But Don’t Forget About Taxes

One of the most appreciated fringe benefits for owners and employees of small businesses is the use of a company car. This perk results in tax deductions for the employer as well as tax breaks for the owners and employees...

Read more

Is Your Business Underestimating The Value of Older Workers?

The job market remains relatively tight for businesses. This includes businesses looking to fill open positions or simply add top talent when the fit is right. That means it’s still important for companies to continuously reassess where they’re looking for...

Read more

There still may be time to reduce your small business 2023 tax bill

In the midst of holiday parties and shopping for gifts, don’t forget to consider steps to cut the 2023 tax liability for your business. You still have time to take advantage of a few opportunities. Time Deductions & Income Does...

Read more

Smaller Companies: Explore Pooled Employer Plans for Retirement Benefits

Most businesses today need to offer a competitive employee benefits package. Failing to do so could mean falling behind in the competition to hire and retain talent in today’s tight job market. When it comes to retirement plans for employees,...

Read more

A Cost Segregation Study May Cut Taxes and Boost Cash Flow

Is your business depreciating over 30 years the entire cost of constructing the building that houses your enterprise? If so, you should consider a cost segregation study. It may allow you to accelerate depreciation deductions on certain items, thereby reducing...

Read more

Some Businesses May Have An Easier Path To Financial Statements

There’s no getting around the fact that accurate financial statements are imperative for every business. Publicly held companies are required to not only issue them, but also have them audited by an independent CPA. Audited financial statements provide the highest...

Read more

Choosing A Business Entity: Which Way To Go?

Are you planning to start a business or thinking about changing your business entity? If yes, then you need to determine what will work best for you. Should you operate as a C corporation or a pass-through entity such as...

Read more

Is Your Business Subject To The New BOI Reporting Rules?

The Corporate Transparency Act (CTA) was signed into law to fight crimes commonly associated with illegal business activities. A couple examples include terrorist financing and money laundering. If your business can be defined as a “reporting company” under the CTA,...

Read more

New Per Diem Business Travel Rates Kicked In On October 1

Are employees at your business traveling and frustrated about documenting expenses? Or perhaps you’re annoyed at the time and energy that goes into reviewing business travel expenses. There may be a way to simplify the reimbursement of these expenses. In...

Read more

Businesses: Know Who Your Privileged Users Are … and Aren’t

Given the pervasiveness of technology in the business world today, most companies are sitting on treasure troves of sensitive data that could be abducted, exploited, corrupted or destroyed. Of course, there’s the clear and present danger of external parties hacking...

Read more

The Social Security Wage Base for Employees and Self-Employed People is Increasing in 2024

The Social Security Administration recently announced that the wage base for computing Social Security tax will increase to $168,600 for 2024 (up from $160,200 for 2023). Wages and self-employment income above this threshold aren’t subject to Social Security tax. Basic...

Read more

What Businesses Can Expect from a DOL Benefits Plan Audit

All but the smallest businesses today are generally expected to offer employees “big picture” benefits. This includes health insurance and a retirement plan. Among the risks of doing so is that many popular plan types must comply with the Employee...

Read more

Business Automobiles: How the Tax Depreciation Rules Work

Do you use an automobile in your trade or business? If so, you may question how to determine business automobile depreciation tax deductions. The rules are complicated, and special limitations that apply to vehicles classified as passenger autos (which include...

Read more

Valuations Can Help Business Owners Plan For The Future

If someone was to suggest that you should get a business valuation, you might wonder whether the person was subtly suggesting that you retire and sell the company. Seriously though, a valuation can serve many purposes other than preparing your...

Read more

What Types of Expenses Can’t be Written Off By Your Business?

If you read the Internal Revenue Code (and you probably don’t want to!), you may be surprised to find that most business deductions aren’t specifically listed. There are also several non-deductible business expenses that many are not aware of. For...

Read more

Could Value-Based Sales Boost Your Company’s Bottom Line?

If your company sells products or services to other businesses, you’re probably familiar with the challenge of growing your sales numbers. At times, you might even struggle to maintain them. One way to put yourself in a better position to succeed...

Read more

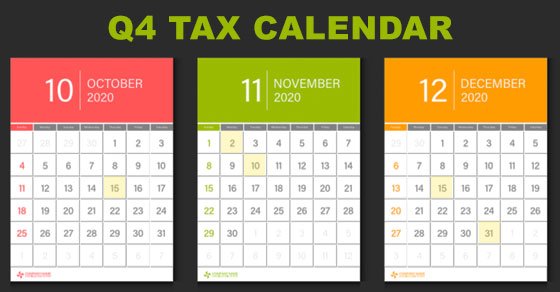

2023 Q4 Tax Calendar: Key Deadlines for Businesses & Other Employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to...

Read more

What Businesses Can Expect From A Green Lease

With events related to climate change continuing to rock the news cycle, many business owners are looking for ways to lessen their companies’ negative environmental impact. One move you may want to consider, quite literally, is relocating to a commercial...

Read more

Update on Depreciating Business Assets

The Tax Cuts and Jobs Act liberalized the rules for depreciating business assets. However, the amounts change every year due to inflation adjustments. And due to high inflation, the adjustments for 2023 were big. Here are the numbers that small...

Read more

Could Your Business Benefit From Interim Financial Reporting?

When many business owners see the term “financial reporting,” they immediately think of their year-end financial statements. And, indeed, properly prepared financial statements generated at least once a year are critical. But engaging in other types of financial reporting more frequently...

Read more

Divorcing Business Owners Should Pay Attention To The Tax Consequences

If you’re getting a divorce, you know the process is generally filled with stress. But if you’re a divorcing business owner, tax issues can complicate matters even more. Your business ownership interest is one of your biggest personal assets and...

Read more

Reviewing & Adjusting Your Marketing Strategy

As summer slips away and fall shuffles forth, business owners and their leadership teams might want to take a look at the overall marketing strategy they’ve pursued this year. How’s yours doing? It may not be entirely too late...

Read more

Look Carefully At Three Critical Factors Of Succession Planning

The day-to-day demands of running a business can make it difficult to think about the future. And by “future,” we’re not necessarily talking about how your tax liability will look at year-end or how you might grow the bottom line...

Read more

Planning Ahead for 2024: Should Your 401(k) Help Employees with Emergencies?

The SECURE 2.0 Act, which was enacted last year, contains wide-ranging changes to retirement plans. One provision in the law is that eligible employers will soon be able to provide more help to staff members facing emergencies. This will be...

Read more

Receive more than $10,000 in cash at your business? Here’s what you must do

Does your business receive large amounts of cash or cash equivalents? If so, you’re generally requirements for currency transaction reports to the IRS — and not just on your tax return. The Requirements Each person who, in the course of...

Read more

5 Tips For More Easily Obtaining Cyberinsurance

Every business should dedicate time and resources to cybersecurity. Hackers are out there, in many cases far across the globe, and they’re on the prowl for vulnerable companies. These criminals typically strike at random — doing damage to not only...

Read more

A Tax-Smart Way To Develop & Sell Appreciated Land

Let’s say you own highly appreciated land that’s now ripe for real estate development. If you subdivide it, develop the resulting parcels and sell them off for a hefty profit, it could trigger a large tax bill. In this scenario,...

Read more

Consider Adverse Media Screening To Vet Vendors, Customers & Others

Whether you know it or not, if your business has ever applied for a commercial loan, you’ve likely been subject to “adverse media screening.” Under this commonly used practice, a prospective borrower is “screened against” various media sources to determine...

Read more

Corporate Officers or Shareholders: How Should You Treat Expenses Paid Personally?

If you play a major role in a closely held corporation, you may sometimes spend money on corporate expenses personally. These costs may end up being nondeductible both by an officer and the corporation unless the correct steps are taken....

Read more

Use An S Corporation To Mitigate Federal Employment Tax Bills

If you own an unincorporated small business, you probably don’t like the size of your self-employment (SE) tax bills. No wonder! For 2023, the SE tax is now at the painfully high rate of 15.3% on the first $160,200 of...

Read more

Strong Billing Processes Are Critical To Healthy Cash Flow

Once a business is up and running, one fundamental aspect of operations that’s easy to take for granted is billing. Often, a system of various processes is put in place and leadership might consider occasional billing mistakes to be part...

Read more

Starting A Business? How Expenses Will Be Treated On Your Tax Return

Government officials saw a large increase in the number of new businesses launched during the COVID-19 pandemic. And the U.S. Census Bureau reports that business applications are still increasing slightly (up 0.4% from April 2023 to May 2023). The Bureau...

Read more

Solo Business Owner? There’s a 401(k) for that

If you own a successful small business with no employees, you might be ready to set up a self-employed retirement plan. Now a 401(k) might seem way out of your reach — only bigger companies can manage one of those,...

Read more

The Trust Fund Recovery Penalty: Who can it be personally assessed against?

If you own or manage a business with employees, there’s a harsh tax penalty that you could be at risk for paying personally. The IRS Trust Fund Recovery Penalty (TFRP) applies to Social Security and income taxes that are withheld...

Read more

Cultivate Connections With A Well-Used CRM System

Has your business invested in customer relationship management CRM software? Many companies have. In fact, according to research cited by career-resource website Zippia, 91% of businesses with 10 or more employees use it. Essentially, CRM software enables you to gather,...

Read more

2023 Q3 tax calendar: Key deadlines for businesses and other employers

Here are some of the key deadlines affecting businesses and other employers during for 2023 Q3 taxes. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re...

Read more

Hiring Family Members Can Offer Tax Advantages (But Be Careful)

Summertime can mean hiring time for many types of businesses. With legions of working-age kids and college students out of school, and some spouses of business owners looking for part-time or seasonal summer job opportunities, companies may have a much...

Read more

DOs and DON’Ts When Deducting Business Meal and Vehicle Expenses

If you’re claiming deductions for business meals or auto expenses, expect the IRS to closely review them. In some cases, taxpayers have incomplete documentation or try to create records months (or years) later. In doing so, they fail to meet...

Read more

Avoid Succession Drama with a Buy-Sell Agreement

Recently, the critically acclaimed television show “Succession” aired its final episode. If the series accomplished anything, it was depicting the chaos and uncertainty that can take place if a long-time business owner fails to establish a clearly written and communicated...

Read more

The IRS Has Just Announced 2024 Amounts for Health Savings Accounts

The IRS recently released guidance providing the 2024 inflation-adjusted amounts for Health Savings Accounts (HSAs). HSA Fundamentals An HSA is a trust created or organized exclusively for the purpose of paying the “qualified medical expenses” of an “account beneficiary.” An...

Read more

Is It Time For A Targeted Marketing Campaign?

If you’ve been in business a while, you might assume that you know exactly who your customers are. But, as the saying goes, “life comes at you fast.” Customer desires, preferences and demographics can all shift before you know it. One way...

Read more

If You’re Hiring Independent Contractors, Make Sure They’re Properly Handled

Many businesses use independent contractors to help keep their costs down — especially in these times of staff shortages and inflationary pressures. If you’re among them, be careful that these workers are properly classified for federal tax purposes. If the...

Read more

Addressing Pay Equity At Your Business

Businesses today are under greater pressure to fully understand and thoroughly respond to the issue of pay equity. And neither of these two broad undertakings is particularly easy. First, fully understanding what pay equity is and whether and how it...

Read more

Use The Tax Code To Make Business Losses Less Painful

Whether you’re operating a new company or an established business, losses can happen. The federal tax code may help soften the blow by allowing businesses to apply losses to offset taxable income in future years, subject to certain limitations. Qualifying...

Read more

6 Tried-and-True Strategies for Improving Collections

Businesses that operate in the retail or restaurant spheres have it relatively easy when it comes to debt collection. They generally take payments right at a point-of-sale terminal and customers go on their merry ways. (These enterprises face many other...

Read more

Education Benefits Help Attract, Retain & Motivate Your Employees

One popular fringe benefit is an education assistance program that allows employees to continue learning. Employees can also earn a degree with financial assistance from their employers under this program. One way to attract, retain and motivate employees is to...

Read more

Businesses, Be Prepared To Champion The Advantages Of An HSA

With concerns about inflation in the news for months now, most business owners are keeping a close eye on costs. It can be difficult to control costs related to mission-critical functions such as overhead and materials. However, you might find...

Read more

4 Ways Corporate Business Owners Can Help Ensure Their Compensation Is “Reasonable”

If you’re the owner of an incorporated business, you know there’s a tax advantage to taking money out of a C corp salary vs dividends. The reason: A corporation can deduct the salaries and bonuses that it pays executives, but...

Read more

Strengthen Strategic Planning With Competitive Intelligence

Business owners and their leadership teams are rightly urged to engage in regular strategic business planning to move their companies, thoughtfully and consciously, in a positive direction. However, no matter how sound a set of strategic objectives might be, it’s...

Read more

The Tax Advantages Of Hiring Your Child This Summer

Summer is around the corner so you may be thinking about hiring young people at your small business. At the same time, you may have children looking to earn extra spending money. You can save family income and payroll taxes...

Read more

It’s Happening: Using Social Media For Customer Service

Everyone is on social media these days, including businesses and their customers. This creates a natural — or shall we say virtual — nexus for companies to field questions, comments and complaints from buyers or those interested in their products...

Read more

How Businesses Can Use Stress Testing To Improve Risk Management

If you’ve been following the news lately, you’ve surely heard or read about the sudden rise in concern about the banking industry. Although the story is still unfolding, an important lesson for business owners is already clear: You’ve got to...

Read more

Choosing An Entity For Your Business? How About An S Corporation?

Are you starting a business with some partners and wondering what type of business entity to form? If yes, an S corporation may be the best business structure for your new venture. Here are some of the reasons why. One...

Read more

ACA Penalties Will Rise In 2024

Recently, the IRS announced 2024 indexing adjustments to the applicable dollar amount used to calculate employer shared responsibility Affordable Care Act penalties. Although next year might seem a long way off, it’s best to get an early start on determining whether...

Read more

2023 Q2 Tax Calendar: Key Deadlines For Businesses & Employers

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact...

Read more

Section 174 Updates: Time To Review The R&E Strategy Of Your Business

It’s been years since the Tax Cuts and Jobs Act (TCJA) of 2017 was signed into law, but it’s still having an impact. Several provisions in the law have expired or will expire in the next few years. One provision...

Read more

Keep An Eye Out For Executive Fraud

Occupational fraud can be defined as crimes committed by employees against the organizations that they work for. Perhaps its most dangerous variation is executive fraud — that is, wrongdoings by those in the C-Suite. Senior-level execs are in a prime...

Read more

Buying A New Business Vehicle? A Heavy SUV Is A Tax-Smart Choice

If you’re buying or replacing a vehicle that you’ll use in your business, you'll want to know about the heavy SUV tax deduction. This vehicle style may provide a more generous tax break this year than you’d get from a...

Read more

Influencer Marketing Could Help Your Business (Or Not)

Most companies today have some sort of social media strategy as part of their efforts for their online presence. If you’ve spent any time online as a business owner, you’d probably agree that building a following and getting meaningful reactions...

Read more

Key Tax Issues In M&A Transactions

There was a dramatic decrease in recent Mergers and Acquisitions activity last year. This is due to rising interest rates and a slowing economy. The total value of M&A transactions in North America in 2022 was down 41.4% from 2021,...

Read more

How Might the Internet of Things Affect Your Business?

Once upon a time, there was the Internet. Relatively speaking, it was easy to understand. The Internet was (and is) a network on which any computer on the planet can communicate with other like-connected computers, enabling users to correspond and...

Read more

Have Employees Who Receive Tips? Here Are The Tax Implications

Many businesses in certain industries employ individuals who receive tips as part of their compensation. These businesses include restaurants, hotels and salons. Here are some key things to know regarding taxes on cash tips. Tip Definition Tips are optional payments...

Read more

Look to a SWOT Analysis To Make Better HR Decisions

Many business owners spend most of their time developing strategic plans, overseeing day-to-day operations and, of course, putting out fires. Yet an underlying source of both opportunity and trouble can be human resources (HR). Think about it: The performance of your...

Read more

Many Tax Limits Affecting Businesses Have Increased For 2023

An array of tax-related limits that affect businesses are indexed annually, and due to high inflation, tax limits for 2023 have increased more than usual. Here are some that may be important to you and your business. Social Security Tax...

Read more

3 Ways Your Business Can Uncover Cost Cuts

Every business wants to find them, but they sure don’t make it easy. We’re talking about cost cutting measures for business. Meaning, clear and substantial ways to lower expenses, thereby strengthening cash flow and giving you a better shot at...

Read more

How The New SECURE 2.0 Law May Affect Your Business

If your small business has a retirement plan, and even if it doesn’t, you may see changes and benefits from a new law. The Setting Every Community Up for Retirement Enhancement 2.0 Act (SECURE Act 2.0) was recently signed into...

Read more

Getting Into Data Analytics Without Breaking The Bank

Most business owners would probably agree that, in today’s world, data rules. But finding, organizing and deriving meaning from the terabytes upon terabytes of information out there isn’t easy. How can your company harness the power of data without throwing dollars...

Read more

Employers Should Be Wary Of ERC Claims That Are Too Good To Be True

The Employee Retention Credit (ERC) was a valuable tax credit that helped employers that kept workers on staff during the height of the COVID-19 pandemic. As of 2023, the credit is no longer available. However, eligible employers that haven’t yet...

Read more

Unused PTO A Problem? Consider A Contribution Arrangement

A new year has arrived. For many businesses, this means employees’ paid time off (PTO) arrangements have reset, per PTO accrual policy. And at companies with “use it or lose it” policies, workers have likely left a few or perhaps...

Read more

The Standard Business Mileage Rate Is Going Up In 2023

Although the national price of gas is a bit lower than it was a year ago, the optional standard mileage rate used to calculate the deductible cost of operating an automobile for business will be going up in 2023. There...

Read more

Look Forward To Next Year By Revisiting Your Business Plan

Businesses of all stripes are about to embark upon a new calendar year. Whether you’ve done a lot of strategic planning or just a little, a good way to double-check your business objectives and expectations is by updating a business...

Read more

2023 Q1 Tax Calendar: Key Deadlines For Businesses & Other Employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. If you have...

Read more

Inbound vs. Outbound: Balancing Your Company’s Sales Strategies

It might sound like the lingo of air traffic controllers: Inbound vs. Outbound. But businesses of all types must grapple with these concepts and the associated challenges when developing sales strategies. Inbound sales originate when someone contacts your company to...

Read more

Do You Qualify For The QBI deduction? And Can You Do Anything By Year-End To Help Qualify?

If you own a business, you may wonder if you’re eligible to take the qualified business income (QBI) deduction. Sometimes this is referred to as the pass-through deduction or the Section 199A deduction. The QBI deduction is: Available to owners...

Read more

Does Your Family Business’s Succession Plan Include Estate Planning Strategies?

Family-owned businesses face distinctive challenges when it comes to succession planning or business inheritance. For example, it’s important to address the distinction between ownership succession and management succession. When a non-family business is sold to a third party, ownership...

Read more

Intangible Assets: How Must The Costs Incurred Be Capitalized?

These days, most businesses have some intangible assets. The tax treatment of these assets can be complex. What makes intangibles so complicated? When buying business assets, in order for it to qualify as an intangible, IRS regulations require the capitalization...

Read more

Choosing A Retirement Plan For Your Small Business

Most growing small businesses reach a point where the owner looks around at the leadership team and says, “It’s time. We need to offer a retirement plan for employees.” Often, this happens when the company is financially stable enough to...

Read more

Is Your Business Closing? Here Are Your Final Tax Responsibilities

Closing a business tax implications is something everything business owner should be aware of and prepared for. Businesses shut down for many reasons. Some of the reasons that businesses permanently close their doors: An owner retirement. A lease expiration. Staffing...

Read more

Like Every Business, A Start-Up Needs A Sensible Budget

An impressive 432,834 new business applications for tax identification numbers were submitted during October 2022, according to the U.S. Census Bureau. Indeed, despite the relatively higher costs of doing business these days, plenty of Americans are still starting a new...

Read more

Computer Software Costs: How Does Your Business Deduct Them?

These days, most businesses buy or lease computer software to use in their operations. Or perhaps your business develops computer software to use in your products or services or sells or leases software to others. In any of these situations,...

Read more

How Should Your Marketing Strategy Change Next Year?

The current calendar year is winding down and a fresh 12 months lies ahead. That makes now a good time to think about marketing trends for 2023. Take the time to assess on how you should present yourself to customers...

Read more

2023 limits for businesses that have HSAs — or want to establish them

No one needs to remind business owners that the cost of employee health care benefits keeps going up. One way to provide some of these benefits is through an employer-sponsored Health Savings Account (HSA). For eligible individuals, an HSA offers...

Read more

Reinforce Your Cybersecurity Defenses Regularly

If you’ve been in business for any amount of time, you probably don’t need anyone to tell you about the importance of company cybersecurity. However, unlike the lock to a physical door, which generally lasts a good long time, measures...

Read more

Inflation Means You & Your Employees Can Save More for Retirement in 2023

How much can you and your employees contribute to your 401(k)s next year, or other retirement plans? In Notice 2022-55, the IRS recently announced cost of living adjustments that apply to the dollar limitations for pensions, as well as other...

Read more

Supplementing Your Company’s Health Care Plan With An EBHRA

Is your business ready to take its health care benefits to the next level? One way to do so is to supplement group health coverage with an Excepted Benefit Health Reimbursement Arrangement (EBHRA). Here are some pertinent details. Rules To...

Read more

Employers: In 2023, the Social Security Wage Base Is Going Up

The Social Security Administration recently announced that the Social Security wage base tax will increase to $160,200 for 2023 (up from $147,000 for 2022). Wages and self-employment income above this threshold aren’t subject to Social Security tax. Basics About Social...

Read more

Manageable Growth Should Be a Strategic Planning Focus

When a company’s leadership engages in a strategic planning meeting, growing the business is typically at the top of the agenda. This is as it should be: ambition is part and parcel of being a successful business owner. What’s more,...

Read more

Providing Fringe Benefits To Employees With No Tax Strings Attached

Businesses can provide benefits to employees that don’t cost them much or anything at all. However, in some cases, employees may have to pay tax on the value of these benefits. Here are examples of two types of nontaxable fringe...

Read more

M&A on the way? Consider a QOE report

Whether you’re considering selling your business or acquiring another one, due diligence is a must. In many mergers and acquisitions (M&A), prospective buyers obtain a quality of earnings report (QOE) to evaluate the accuracy and sustainability of the seller’s reported...

Read more

What Local Transportation Expenses Can Your Business Deduct?

You and your small business are likely to incur a variety of local transportation expenses each year. There are various tax implications for these costs. First, what is “local transportation?” It refers to travel in which you aren’t away from...

Read more

Shine A Light On Sales Prospects To Brighten The Days Ahead

When it comes to sales, most businesses labor under two major mandates: Keep selling to existing customers. Find new ones (sales prospects). To accomplish the former, your sales staff probably gets some help from the marketing and customer service departments....

Read more

Worried About An IRS Audit? Prepare In Advance

IRS audit rates are historically low, according to a recent Government Accountability Office (GAO) report , but that’s little consolation if your return is among those selected to be examined. Plus, the IRS recently received additional funding in the Inflation...

Read more

Formalizing Your Business’s BYOD Policy

When the pandemic hit about two and a half years ago, thousands of employees suddenly found themselves working from home. In many cases, this meant turning to personal devices to access their work email, handle documents and perform other tasks....

Read more

Work Opportunity Tax Credit Provides Help To Employers

In today’s tough job market and economy, the Work Opportunity Tax Credit (WOTC) may help employers. Many business owners are hiring and should be aware that the WOTC is available to employers that hire workers from targeted groups who face...

Read more

How To Handle Evidence In A Fraud Investigation At Your Business

Every business owner should establish strong policies, procedures and internal controls to prevent fraud. But don’t stop there. Also be prepared to act if indications arise that, despite your best efforts, wrongdoing has taken place at your company. How you...

Read more

2022 Q4 Tax Calendar: Key Deadlines for Businesses & Other Employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to...

Read more

Separating Your Business From Its Real Estate

Does your business need real estate to conduct operations? Or does it otherwise hold property and put the title in the name of the business? You may want to rethink this approach. Any short-term benefits may be outweighed by the...

Read more

Sometimes Businesses Need To Show Customers Tough Love

“We love our customers!” Many businesses proclaim this at the bottom of their invoices, in their marketing materials and even on the very walls of their physical locations. Obviously, every company needs a solid customer or client base to survive....

Read more

Year-End Tax Planning Ideas For Your Small Business

Now that Labor Day has passed, it’s a good time to think about making moves that may help lower your small business taxes for this year and next. The standard year-end tax planning approach of deferring income and accelerating deductions...

Read more

Make Marketing Better With A Brand Audit

Mention the word “audit” to a business owner and you’ll probably get an anxious look. But not all audits are of the tax, financial statement or retirement plan variety. Besides an IRS audit, you can audit many areas of your...

Read more

Inflation Reduction Act Provisions of Interest to Small Businesses

The Inflation Reduction Act (IRA), signed into law by President Biden on August 16, contains many provisions related to climate, energy and taxes. There has been a lot of media coverage about the law’s impact on large corporations. For example,...

Read more

Evaluating An ESOP From A Succession Planning Perspective

If you’ve been in business for a while, you’ve probably considered many different employee benefits. One option that might have crossed your desk are employee stock options via employee stock ownership plan (ESOP). Strictly defined, an ESOP is considered a retirement...

Read more

Why An LLC Might Be The Best Choice Of Entity For Your Business

The business entity you choose can affect your taxes, your personal liability and other issues. A limited liability company (LLC) is somewhat of a hybrid entity. This is because its structure can resemble a corporation for owner liability purposes and...

Read more

Is It Time For Your Business To Fully Digitize Its Accounts Receivable?

Electronic payments and in-app purchases are becoming so much the norm. As such, many midsize to large companies have grown accustomed to digitalizing accounts receivable. But there are some smaller businesses that continue to soldier on with only partially automated...

Read more

Provide Employee Parking? Here’s What The IRS Wants To Know

Many offices, plants and other business facilities are once again filled with real, live people. And those hard-working employees need somewhere to park. If your company provides employee parking fringe benefit, the IRS may take an interest in the arrangement....

Read more

How To Treat Business Website Costs For Tax Purposes

These days, most businesses have websites. But surprisingly, the IRS isn't issuing any formal guidance deducting website costs. Fortunately, established rules that generally apply to the deductibility of business costs provide business taxpayers launching a website with some guidance as...

Read more

6 Steps To Easing Employees’ Fears About Business Innovation

Business owners often find the greatest obstacle to innovation isn’t the change itself, but employees’ resistance to it. Their hesitation or outright defiance towards business innovation is frequently driven by fear. Some workers might worry about how the innovation will...

Read more

How To Keep Remote Sales On-Point

The pandemic has dramatically affected the way people interact and do business. Your company likely undertook various changes to adapt to the initial lockdowns and the ongoing public health guidance over the past two years. An interesting byproduct of the...

Read more

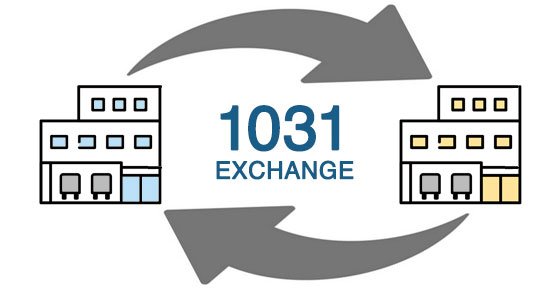

Important Considerations When Engaging In A Like-Kind Exchange

A business or individual might be able to dispose of appreciated real property without being taxed on the gain by exchanging it rather than selling it. You can defer tax on your gain through a “like-kind” or Section 1031 exchange....

Read more

The Tax Obligations If Your Business Closes Its Doors

Sadly, it has been all too common with businesses shutting down recently due to the pandemic and the economy. If this is your situation, we can assist you, including taking care of the various tax responsibilities with closing a business....

Read more

How Do Taxes Factor Into An M&A Transaction?

Mergers and acquisitions have been decreasing in 2022, according to various reports. However, there are still companies being bought and sold. Is your business is considering merging with or purchasing another business? If so, it’s important to understand taxing of...

Read more

IRS Extends Relief For Physical Presence Signature Requirement

Under IRS regulations regarding electronic consents and elections, if a signature must be witnessed by a retirement plan representative or notary public, it must be witnessed “in the physical presence” of the representative or notary — unless guidance has provided...

Read more

2022 Q3 Tax Calendar: Key Deadlines for Businesses & Other Employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to...

Read more

When Hiring, Don’t Overlook Older Workers

Is your business hiring older workers? Many companies are. In fact, an employment report released by the U.S. Department of Labor earlier this month revealed that non-farm payrolls increased by 390,000 in May, and the unemployment rate held steady at...

Read more

Checking In On Your Accounts Payable Processes

Accounts payable is a critical area of concern for every business. However, as a back-office function, it doesn’t always get the attention it deserves. Once in place, accounts payable processes tend to get taken for granted. Following are some tips...

Read more

Is Your Corporation Eligible For The Dividends-Received Deduction?

There’s a valuable tax deduction available to a C corporation when it receives dividends. The “dividends-received deduction” is designed to reduce or remove an extra level of tax on dividends received by a corporation. As a result, a corporation will...

Read more

Simple Ways To Make Strategic Planning A Reality

Every business wants to engage in a strategic plan that will better position the company to sell more to current customers. Perhaps a business aims to expand into new markets. Yet the term “strategic planning” is so broad. It's overwhelming...

Read more

Dodge The Tumult With A Buy-Sell Agreement

A multiple ownership business generally benefit from a variety of viewpoints, diverse experience and strategic areas of specialization. However, there’s a major risk: the company can be facing turmoil if one of the owners decides to leave. A logical and...

Read more

Partners May Have To Report More Income On Tax Returns Than They Receive In Cash

The inscreas in interest Are you a partner in a business? You may have come across a situation regarding partnership tax rules that’s puzzling. In a given year, you may be taxed on more partnership income than was distributed to...

Read more

3 Summertime Marketing Ideas for 2022

You can’t stop it; you can only hope to use it to your best business advantage. That’s right, summer is on the way and, with it, a variety of seasonal marketing opportunities for small to midsize companies. Here are three...

Read more

Supply Chain Software Can Help Digitize The Dilemma

It’s a dilemma that’s been in the news and on business owners’ minds for a while now. The COVID-19 pandemic, along with other world events, have strained supply chains challenges both global and national. And, throwing gasoline on the fire,...

Read more

Businesses: Prepare for the Lower 1099-K Filing Threshold

Businesses should be aware that they may be responsible for issuing more information reporting forms for 2022 because more workers may fall into the required range of income to be reported. Beginning this year, the threshold has dropped significantly for...

Read more

Could Your Business Benefit From A PEO?

:Keeping up with employment regulations and health care benefits can be a struggle for many small to midsize businesses. One potential solution is engaging a professional employer organization (PEO). PEOs employ experts who understand the minutiae of many HR functions....

Read more

Inflation Enhances the 2023 Amounts for Health Savings Accounts

The IRS recently released guidance providing the 2023 inflation-adjusted amounts for Health Savings Accounts (HSAs). High inflation rates will result in the increase of next year’s amounts more than they have been in recent years. HSA Basics Establishing an HSA...

Read more

Tighten Up Billing & Collections To Mitigate Economic Uncertainties

While many economic indicators remain strong, the U.S. economy is still giving business owners plenty to think about. The nation’s gross domestic product unexpectedly contracted in the first quarter of 2022. Rising inflation is on everyone’s mind. Additionally, global supply...

Read more

Businesses May Receive Notices About Information Returns That Don’t Match IRS Records

The IRS has begun mailing notices to businesses, financial institutions and other payers that filed certain returns with information that doesn’t match agency's records. These CP2100 and CP2100A notices are sent by the IRS twice a year to payers who...

Read more

No Parking: Unused Compensation Reductions Can’t Go To Health FSA

Among the many lasting effects of the pandemic is that some businesses are allowing employees to continue working from home. This is even now that the most acute phases of the public health crisis seem to be over in some...

Read more

The Tax Mechanics Involved In The Sale of Trade or Business Property

There are many rules that can potentially apply to the sale of business property. Thus, to simplify discussion, let’s assume that the property you want to sell is land or depreciable property and is in use by your business. Additionally,...

Read more

Businesses Looking For Outside Investors Need A Sturdy Pitch Deck

Is your business ready to seek funding from outside investors? Perhaps you’re a start-up that needs money to launch as robustly as possible. Or maybe your company has been operating for a while and you want to pivot in a...

Read more

Tax Considerations When Adding A New Partner At Your Business

Adding a new partner in a business partnership has several financial and legal implications. Let’s say you and your partners are planning to admit a new partner. The new partner will acquire a one-third interest in the partnership by...

Read more

Offering Summer Job Opportunities? Double-Check Child Labor Laws

Spring has sprung — and summer isn’t far off. Does your business typically hire minors for summer job opportunities? If so, now’s a good time to brush up on labor laws prior to hiring a child. In News Release No....

Read more

Fully Deduct Business Meals This Year

The federal government is helping to pick up the tab for certain business meals. Under a provision that’s part of one of the COVID-19 relief laws, you can fully deduct business meals at 100% (from the usual deduction of 50%)...

Read more

Undertaking A Pay Equity Audit At Your Business

Pay equity is both required by law and a sound business practice. However, providing equitable compensation to employees who perform the same or similar jobs, while accounting for differences in experience and tenure, isn’t easy. That’s why every company should...

Read more

2022 Q2 Tax Calendar: Key Deadlines For Businesses & Other Employers

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact...

Read more

ERISA and EAPs: What’s The Deal?

In recent years, more and more businesses have increased efforts to support the well-being of their employees. This means not only providing health care benefits, but also offering other initiatives designed to help workers cope with challenges such as substance...

Read more

Establish A Tax-Favored Retirement Plan

Does your business have a retirement plan? If not, now might be a good time to take the plunge. Current retirement plan rules allow for significant tax-deductible contributions. For example, if you’re self-employed one option is to set up a...

Read more

360-Degree Feedback Helps Business Owners See The Big Picture

Business owners are regularly urged to “see the big picture.” In many cases, this imperative applies to a pricing adjustment or some other organizational strategic planning idea. However, seeing the big picture also matters when it comes to managing the...

Read more

Does Your Business Barter? Here Are Some Facts You Should Know

In today’s economy, many small businesses are strapped for cash. They may find it beneficial to barter or trade for goods and services instead of paying cash for them. Bartering is the oldest form of trade and the internet has...

Read more

Business Owners, Lean Into Sales Staff Retention

Although there have been some positive signs for the U.S. economy thus far in 2022, many businesses are still reeling from last year’s “Great Resignation.” This trend of a historic number of workers voluntarily leaving their jobs, combined with the...

Read more

The Election To Apply The Research Tax Credit Against Payroll Taxes

The credit for increasing research activities, often referred to as the research and development (R&D) credit, is a valuable tax break available to eligible businesses. Claiming the credit involves complex calculations, which we can take care of for you. In...

Read more

5 Ways To Control Your Business Insurance Costs

Common sense dictates that every company, no matter how small, should carry various forms of business insurance. But that doesn’t mean you should pay unnecessarily high premiums just to retain the coverage you need. Here are five ways to better...

Read more

Can You Deduct The Costs Of A Spouse On A Business Trip?

If you own your own company and travel for business, you may wonder whether you can deduct the costs of having your spouse accompany you on a business trip. The rules for deducting a spouse’s travel costs are very restrictive....

Read more

Should Your Business Address Retirement Plan Leakage?

Under just about any circumstances, the word “leakage” has negative connotations. And so it follows that this indeed holds true for retirement planning as well. In this context, leakage refers to early, pre-retirement withdrawals from an account. Now, as a...

Read more

Making Withdrawals From Your Closely Held Corporation That Aren’t Taxed As Dividends

Do you want to withdraw cash from your closely held corporation at a minimum tax cost? The simplest way is to distribute cash as a dividend. However, a dividend distribution isn’t tax-efficient since it’s taxable to you to the extent...

Read more

Prudent Technology Upgrades Call For Some Soul Searching

By now, most business owners view technology upgrades as inevitable. Whether hardware or software, the tech your company relies on to operate will need to change slightly or even drastically for you to stay competitive. Strange as it may sound,...

Read more

Important Tax Aspects Of Operating Your Business As A Sole Proprietor

If you’re in business for yourself as a sole proprietor, or you’re planning to start a business, you need to know about the tax aspects of your venture. Here are eight important issues and tax rules for sole proprietors to...

Read more

2022 Deadlines for Reporting Health Care Coverage Information

Ever since the Affordable Care Act was signed into law, business owners have had to keep a close eye on how many employees they’ve had on the payroll. This is because a company with 50 or more full-time employees or...

Read more

Keeping Meticulous Records Is The Key To Tax Deductions & Painless IRS Audits

Are you operate a business, or considering starting a new one? If so, know that detailed business recordkeeping of your income and expenses in necessary. Specifically, you should carefully record your expenses in order to claim all of the tax...

Read more

Entrepreneurs and Taxes: How Expenses Are Claimed On Tax Returns

While some businesses have closed since the start of the COVID-19 crisis, many new ventures have launched. Entrepreneurs have cited a number of reasons why they decided to start a new business in the midst of a pandemic. For example,...

Read more

Let Your Financial Statements Guide You To Optimal Business Decisions