Are You a Small Business Owner and Feeling Overwhelmed?

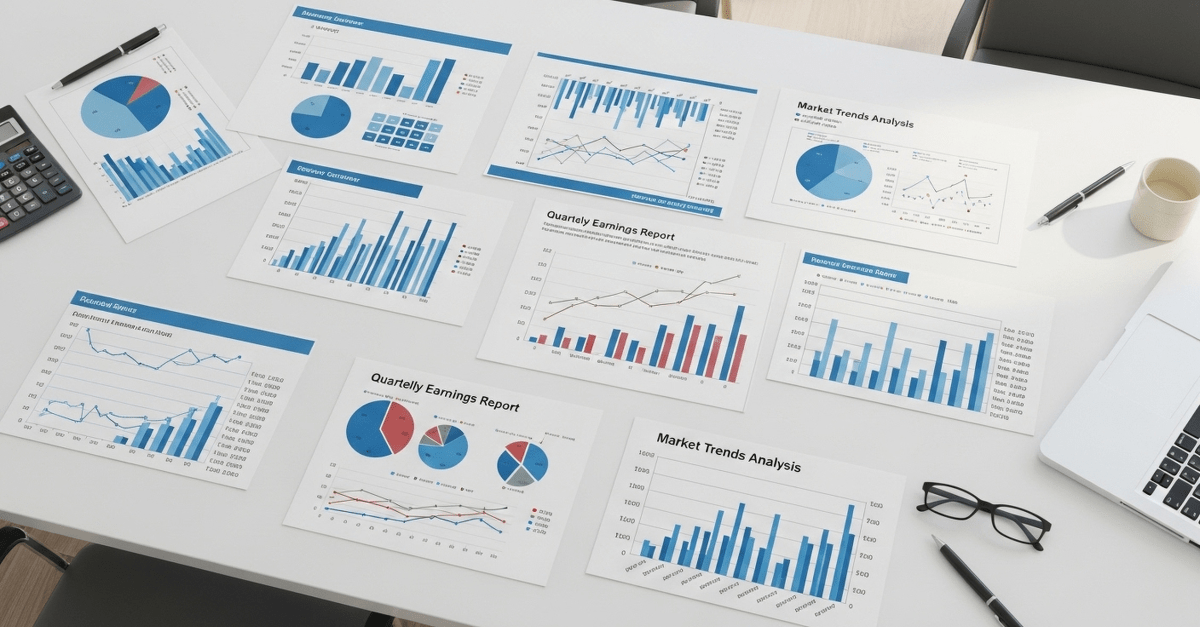

Our Small Business Packages are innovative solutions designed to support your business' day-to-day operations by relieving you of the cumbersome accounting tasks — balancing checkbooks, bookkeeping, paying bills, payroll, financial statement preparation, as well as your retirement planning needs.

Learn more